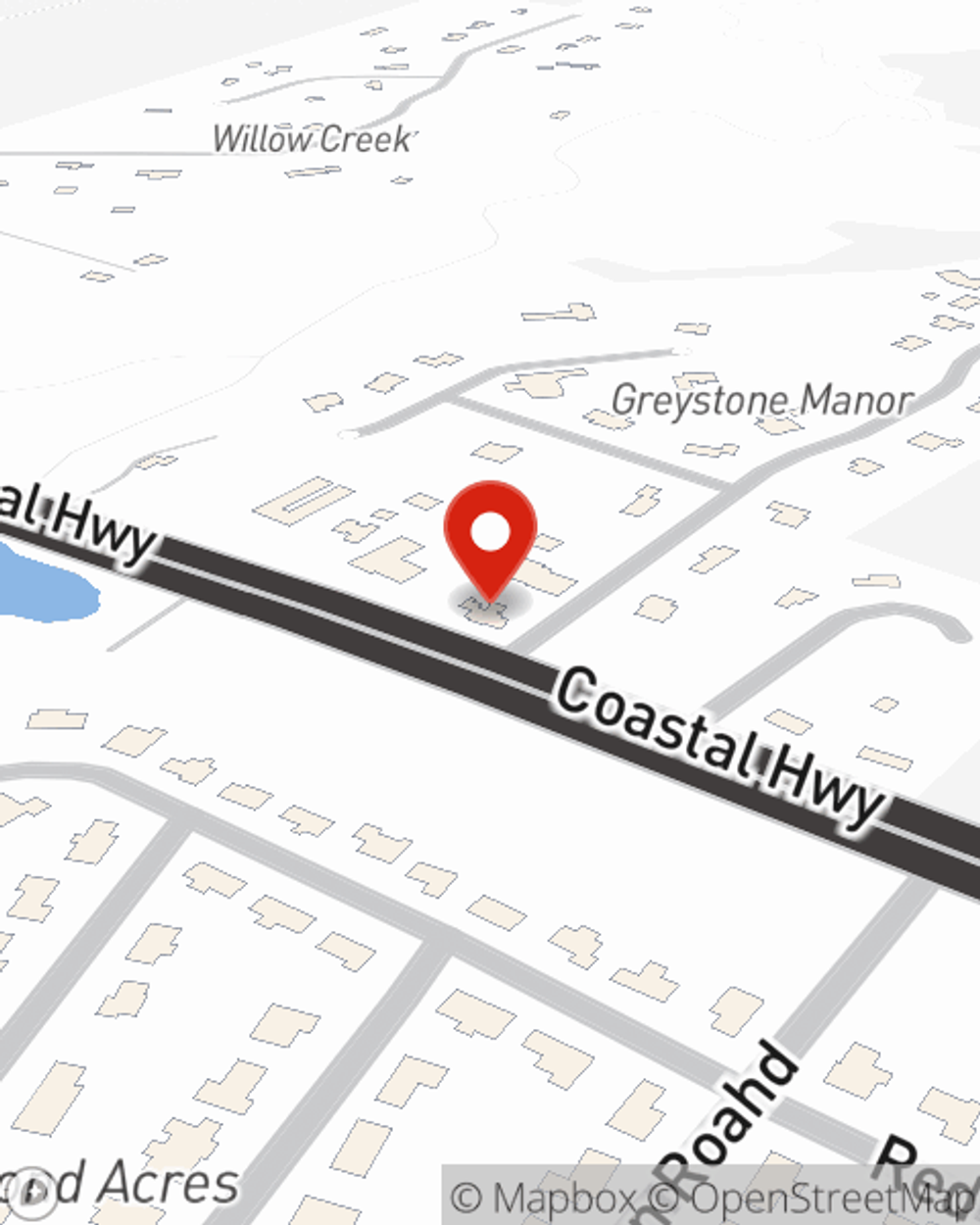

Life Insurance in and around Lewes

Insurance that helps life's moments move on

What are you waiting for?

Would you like to create a personalized life quote?

- Lewes, DE

- Milton, DE

- Rehoboth Beach, DE

- Millsboro, DE

- Ocean View, DE

- Milford, DE

- Salisbury, MD

- Ocean Pines, MD

- Berlin, MD

- Cambridge, MD

- Easton, MD

- Georgetown, DE

- Dover, DE

- Smyrna, DE

- Middletown, DE

- Newark, DE

- Wilmington, DE

- Annapolis, MD

- Cape May, NJ

- Millville, NJ

- Vineland, NJ

- Delaware County, PA

- Chester County, PA

- Philadelphia, PA

Be There For Your Loved Ones

It can be a big responsibility to provide for your loved ones, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can pay off debts and/or keep paying for your home as they mourn your loss.

Insurance that helps life's moments move on

What are you waiting for?

Life Insurance You Can Trust

You’ll get that and more with State Farm life insurance. State Farm has outstanding coverage options to keep those you love safe with a policy that’s modified to align with your specific needs. Fortunately you won’t have to figure that out by yourself. With true commitment and excellent customer service, State Farm Agent Tommy Taylor walks you through every step to generate a plan that secures your loved ones and everything you’ve planned for them.

Simply reach out to State Farm agent Tommy Taylor's office today to find out how a State Farm policy can work for you.

Have More Questions About Life Insurance?

Call Tommy at (302) 644-3276 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Tommy Taylor

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.